when will capital gains tax increase uk

In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax basic rate band. Labour has indicated it would increase taxes on.

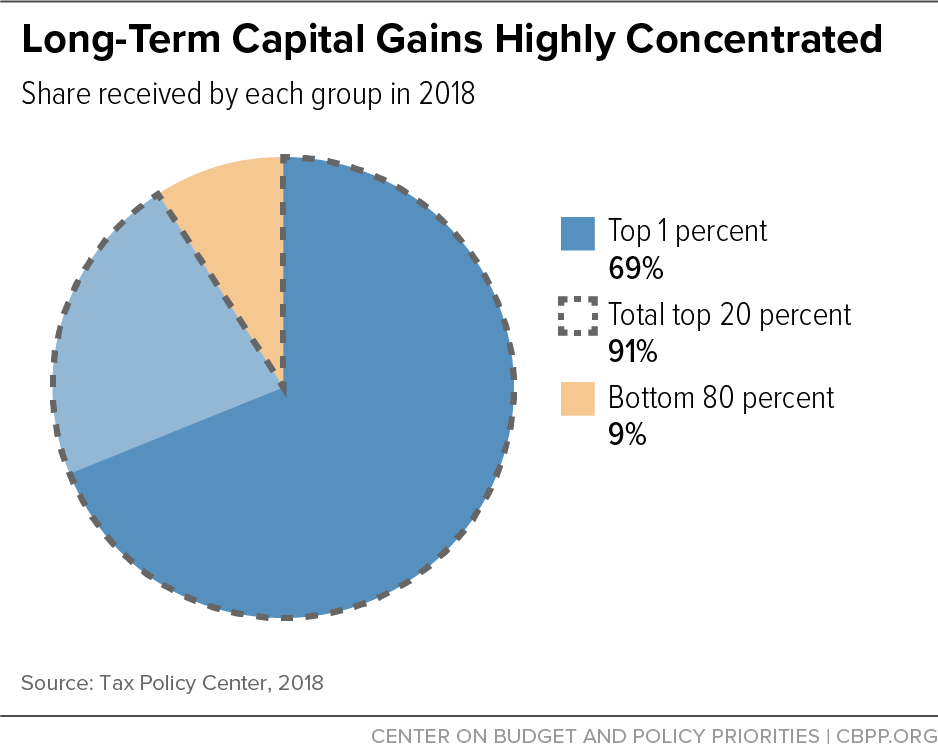

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

In your case where capital gains from.

. If you make a gain after selling a property youll pay 18. Our capital gains tax rates guide explains this in more detail. Ive used up my ISA and SIPP allowances for the year and Im starting to explore capital gains tax harvesting.

Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home. 18 and 28 tax rates for individuals for. Note that short-term capital gains taxes are even higher.

Dividend tax rates to increase. Or could the tax rate be retroactively applied to the 202122 tax year. Id like to invest a lump sum in a product which generates relatively reliable gains.

Salary 32000 GBP Yearly. Class 3 1585 per week. The following Capital Gains Tax rates apply.

How Capital Gains Tax. Your overall earnings determine how much of your capital gains are taxed at 10 or 20. In line with the increase in the main rate the UK Diverted Profits Tax rate will also rise to 31 from April 2023.

Find out moreNational Insurances rates. The rate varies based on a number of factors such as your income and. By Katey Pigden 27th October 2021 347 pm.

10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Job in Liverpool - England - UK L3 8EF. For married couples filing jointly the standard deduction will rise to 27700 up from 25900 in the current tax year.

Jeremy Hunt should follow them and raise. Technical Specialist - Capital Gains Tax. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does.

Currently there are four rates of CGT being 18 and 28 on UK. Similarly to the National. 20 28 for residential.

By Charlie Bradley 0700 Thu Oct 28 2021. Capital Gains Tax rates in the UK for 202223. 10 and 20 tax rates for individuals not including residential property and carried interest.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Note that short-term capital gains taxes are even higher. The OTS made a recommendation to scale back the capital gains tax exemption to.

The maximum UK tax rate for capital gains on property is currently 28. Thats an increase of 1800 or a 7 bump. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit.

Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax - and for good reasons.

Capital gains tax CGT is payable when you sell an asset that has increased in value since you bought it. The UKs Capital Gains Tax take was up 42 to 143 billion in 2020-21 from 101 billion in 2019-20. The changes were criticised by a number of groups including the Federation of Small Businesses who claimed that the new rules would increase the CGT liability of small businesses and.

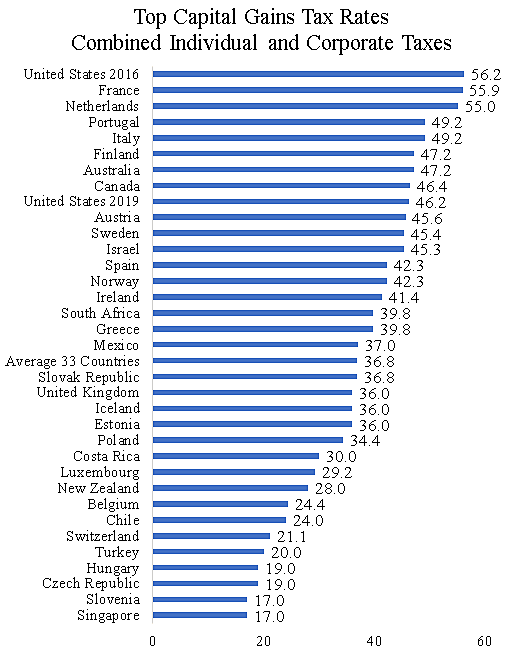

U S Taxpayers Face The 6th Highest Top Marginal Capital Gains Tax Rate In The Oecd Tax Foundation

Founders Will Fly The Nest If You Hike Capital Gains Tax In Budget Business The Sunday Times

Uk Government Shelves Proposals To Increase Capital Gains Tax Rate Your Money

Official Report Recommends Significant Increases In Capital Gains Tax Thompson Wright

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

Capital Gains Definition Rules Taxes And Asset Types

Increase Of Capital Gains Tax To Help Pay For Covid 19 Birkett Long Solicitors

An Overview Of Capital Gains Taxes Tax Foundation

Capital Gains Taxes Already Too High Cato At Liberty Blog

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Rishi Sunak Urged To Mount 14bn Raid On Second Home Owners And Stock Investors

Progressives Tax The Rich Dreams Fade As Democrats Struggle For Votes Wsj

How To Plan For Tomorrowa S Higher Taxes Financial Times Partner Content By Barclays Wealth Management

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax Low Incomes Tax Reform Group

Capital Gains Tax Rises To 28 For Higher Earners Budget The Guardian

Times Faceoff Both Us And Uk Are Planning To Hike Capital Gains Tax Should We Use Revenue To Cut Steep Duties On Fuel Times Of India